If your organization has a strong business culture that prioritizes employee health and safety and a history of low claims, you can: Have greater control over claim management. Know every penny spent on insurance is accounted for. Take the surprises out of renewal time. In less than four minutes, this video can help you determine if a captive is a good fit for your company. To further discuss the captive options we have available, contact Lori Harris, AAI, CPIA, Captive Director / Account Executive at 717.381.3477 or email her at lharris@murrayins.com. Murray is proud to be a part of AssuredPartners, committed to providing Power Through Partnership.

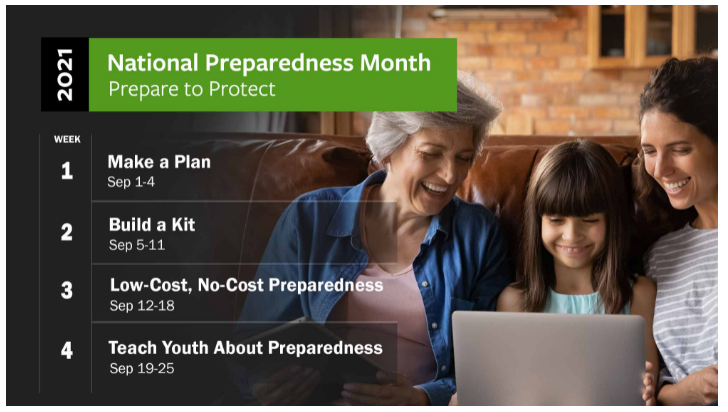

September is National Preparedness Month

According Ready.gov, National Preparedness Month is an observance each September to raise awareness about the importance of preparing for disasters and emergencies that could happen at any time. The 2021 theme is “Prepare to Protect. Preparing for disasters is protecting everyone you love.” Weekly Themes: For more information and resources to regarding National Preparedness Month, go to Ready.gov/september. Questions? Contact a member of the Murray Risk Management Team at 717.397.9600

SBA Bond Guarantee Program – A Great Tool in Increasing Bonding Capacity

By Nick Newton for AssuredPartners Anyone working in the construction bond industry has seen the scenario where a client or prospect is requesting bonding capacity larger than the standard surety market is willing to provide. While some sureties will utilize tools like escrow or collateral, the SBA Bond Guarantee Program offers an alternative solution, enabling greatly increased capacity for your client. The SBA guarantees 80% of the bond obligation to the surety; 90% for firms that are minority-owned, veteran-owned, and service-disabled veteran-owned, 8(a) and HUBZone certified, and all contracts $100,000 or less. This reduced exposure makes it more palatable for the 42 sureties that participate in the program to offer increased bonding capacity. Click for the program highlights>>>

Oklahoma Producers Explore New Approach to Farming, Ranching

By Evan Onstot for Koco.com We grow things here in Oklahoma. Our state’s farming and ranching heritage is as strong here as anywhere. But are most of the state’s producers doing it wrong? Some producers swear there’s a better way: regenerative farming. All producers want to grow better crops and raise healthier animals. And they want to make more money. All of these things are happening for a small group of Oklahoma ranchers who’ve basically thrown out the plow – and decades of tradition. At the entrance to his sprawling Western Oklahoma ranch, not far from the Texas border, Jimmy Emmons has posted his favorite saying: Long Live the Soil. Everything that Emmons does is focused on making his soil …

AssuredPartners: 10 Years of Growth Based on Relationships

By Jim Henderson, Chairman and CEO, AssuredPartners for Business Insurance Consolidation has been an ongoing part of insurance distribution for many years. At AssuredPartners, we’re celebrating the 10th anniversary of our founding. In that time, we have become one of the largest and fastest-growing brokerages in the United States. But our story is more than just achieving a high level of growth. AssuredPartners is all about building lasting relationships – with our clients, our associates, our agency partners, and the insurance companies with which we do business to solve our clients’ risk management needs. A lot has changed in a decade, and as we look back since our founding in 2011, we have seen some of those changes. Certainly many …