By Gina Ekstam for AssuredPartners As the property insurance market continues to put pricing pressure on renewals, some agribusiness operations have benefited from specialty insurance programs, such as stock throughput coverage, to help them navigate the challenging marketplace. A form of inland marine insurance, a stock throughput program insures a product throughout the supply chain and accounts for any potential gaps in coverage. From the time the product is shipped, stored, and delivered to its final destination, there is a lot at stake. A stock throughput policy provides continuous coverage against all risks not explicitly excluded in the contract as long as the insured has ownership or responsibility for the product. What are the benefits>>>

Improve Operational Health, Maximize Flexibility to Mitigate Drought Risk

By Gina Ekstam for AssuredPartners According to NOAA, the average global surface temperature was the sixth highest for August 2021 since global records began in 1880. Further, the U.S. Drought Monitor reports that over 46% of the contiguous U.S. experienced moderate to exceptional drought in August. These extreme weather conditions are impacting ag operations across the country. Decreased water availability leads to production losses, increased pests and diseases, and lower livestock productivity. Matt Carstens, president and CEO of Landus in Ames, Iowa, adds, “drought conditions affect weed and fungi control, changes the products that are stored, and impacts the health of livestock. Operationally, severe weather events can lead to supply chain and infrastructure disruption. For example, a lack of corn …

Infrastructure Lacks Critical Funding

By Kevin Rettberg for AssuredPartners With the September House passage of the latest infrastructure spending bill tagged somewhere around $3.5 trillion, there is still one issue that this bill has not addressed: commercial truck parking. To understand why this is an issue, we need to provide context. It goes without saying, but there is consensus that our nation’s highways and roadways are infrastructure, and as a country there is a continued investment of billions of dollars to maintain and improve them. Another point of agreement, especially having gone through the COVID pandemic, is that our commercial truck drivers are the lifeblood of our economy. Finally, the work that has been done in the industry to make the job safe is …

OSHA’s Top 10 Most Frequently Cited Violations

By Toby Graham for KPA Hot off the press… the new OSHA Top 10 list is here! Every year OSHA compiles a list of the ten most-cited standard violations from the previous fiscal year. OSHA publishes this list to alert employers about these commonly cited standards so they can take necessary steps to find and fix recognized hazards before OSHA shows up. The 2021 fiscal year statistics, which ended Sept. 30th, have just been released. They show some slight changes from the 2020 list. Not surprisingly, the list’s actual violations stayed the same as the previous year, though some standards moved up or down. Click to see the complete list>>>

Firm Insurance Market Expected to Last into Next Year

By Gavin Souter for BusinessInsurance.com Introduction by Jeffrey Gelburd, Vice President, Murray: As we head into the busy year end property / casualty renewal season, it is important to get a head start and have your best foot forward when negotiating renewal terms. With the exception of cyber liability, which is still very much in flux, rate increases on some lines have slowed down, and underwriters are interested in writing new business. After over two years of rate increases and takeaways, it’s in the best interest of insureds to market their program. Progress can now be obtained in negotiating improvements so anyone with good loss experience should use that to their advantage in renewal negotiations. Click to read Firm Insurance …

To Pay or Not to Pay: Is That the Question?

By Scott Sinder for LeadersEdge We are on the heels of the 20th anniversary of 9/11, and many of us lived the Terrorism Risk Insurance Act debates that followed. The widely shared expectation at the time was that 9/11 was just the first of what we thought would be a long litany of terrorist events on U.S. soil. But those never materialized, and, to date, not one claim has been paid through the TRIA program. The recent exponential growth in “ransomware” claims, however, seems to have bucked that trend. There is a spate of more well publicized cases—Colonial Pipeline and CNA?—but as Alejandro Mayorkas, secretary of the U.S. Department of Homeland Security, recently noted, the overall “rate of ransomware attacks …

The Cost of Distracted Driving – A Reminder

By Tyson Keith for AssuredPartners Distracted driving continues to be one of the most dangerous hazards on our roads. Whether it is eating, drinking, scanning the radio, fiddling with the navigation system, or texting on a cell phone, distracted driving causes thousands of accidents every year. According to the National Highway Traffic Safety Administration, in 2019 there were 3,142 lives lost due to crashes resulting from distracted driving. By taking their eyes off the road for just five seconds, while traveling at 55mph, their vehicle can travel the distance of a football field. Please do your part by reminding your drivers of how dangerous it is to drive while distracted. The Minnesota Trucking Association (MTA), recently shared a video produced by the Minnesota …

National Farm Safety Week

By Gina Ekstam for AssuredPartners Fall harvest can be one of agriculture’s busiest and most dangerous times of the year. National Farm Safety and Health Week is observed the third week of September to promote safety throughout the ag industry. While agriculture, forestry, and fishing make up one of the largest industry sectors in the U.S., most operations are small, with nearly 78 percent employing fewer than ten workers and most relying on family members and/or immigrant, part-time, contract, and seasonal labor. Many workers in these small operations are excluded from labor protections, including many of those enforced by OSHA. In 2019, the U.S. Bureau of Labor Statistics reported 573 fatal work injuries in the Ag, Forestry, Fishing & Hunting sector. This represents the …

Does Your Insurance Program Cover All Insurance Requirements in the Contracts You’re Signing?

By Gary Semmer for AssuredPartners A great question to stop and ask yourself – how certain are you that in the event of a claim your insurance program will trigger coverage? Often, contracts get signed, excited to have that piece completed and ready to get moving with the next part. But, if you aren’t checking your insurance program’s fine print ahead of signing a contract you may be signing something that could be the beginning of a major problem later on. Let’s examine 3 problematic areas: Indemnification Additional Insured Requirements Coverage Restrictions or Exclusions Click to read more>>>

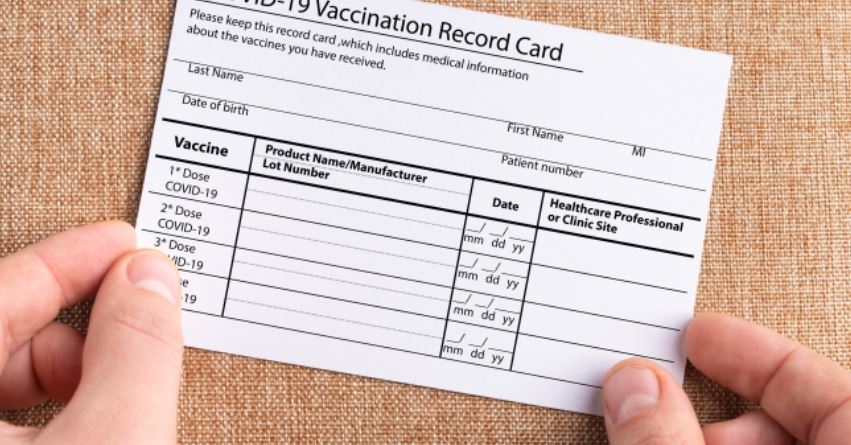

Biden’s Vaccine Mandate & Delta’s Surcharge Signal Sweeping Changes for Employers & Employees

By Nathanael M. Alexander, Esq. for AssuredPartners Since we last blogged about the changes in the world of COVID-19 vaccines there have been plenty of headlining developments that are worthy of mention including the August 23, 2021 FDA approval of the Pfizer vaccine, a woman being arrested in Hawaii for attempting to skirt the state’s entry requirements via the use of a fake vaccination card, and various state law mandates for teachers, healthcare workers, etc. This is all coupled with much enthusiasm from employers hoping to follow in the footsteps of Delta Air Lines’ recent decision to add a $200 monthly health insurance charge for their unvaccinated staff members. This heightened enthusiasm has led many employers to explore the various ramifications (both legal and …