Very few construction projects happen without subcontractors. Some general contractors self-perform all or a portion of the construction work, but, most often, major and minor trades contribute the lion’s share of labor and materials. Read the article >>>

Almost-Completed VA Hospital Project in Colorado More Than $1B Over Budget

The Aurora hospital has been a thorn in the VA’s side for years. The agency will miss the original completion date by four years, but the facility helped catalyze Congress’ decision to put the Army Corps of Engineers in charge of any VA construction project expected to cost $100 million or more. Read about it here >>>

Workers’ Compensation Rate Calculation New Benchmark for Contractors’ Qualification To Bid

A complicated calculation for determining workers compensation premiums has evolved into a do-or-die benchmark on whether contractors are qualified to bid on many jobs, and some say that’s not fair, especially for smaller contractors. It’s called the experience modification rate (EMR), and it’s based on previous workers’ comp claims versus payroll and other factors. The rate can lead to a reduction or increase in a company’s workers’ comp premiums. But over the years, the rate has come to mean much more in the construction industry, where the number has often become the final word on a construction company’s safety practices. Tell me more >>>

Subs On Athletic Apparel Company’s Expansion Seek Recourse For Pay Disputes

Five years in, the ambitious and ever-evolving headquarters expansion at Nike is finally producing the first completed buildings. It’s also left a trail of angry subcontractors. The strikingly modernistic structures taking shape on Nike’s campus near Beaverton have proved difficult and time-consuming to build. Subcontractors and their lawyers claim in court filings the company and its general contractor, Hoffman Construction, have repeatedly modified or broadened the scope of the project while refusing to cover the extra costs. That includes completed work that was ripped out and redone, they say. Get the story here >>>

Navigating Government Shutdowns: Legal Issues For Federal Contractors

By McGuireWoods LLP – JD Supra With the end of the federal government shutdown that began on Jan. 20, 2018, there is a reasonable likelihood that the budget impasse will just be resurrected when yet another short-term funding extension enacted by Congress expires — this time on Feb. 8, 2018. This, in turn, will prolong uncertainty for many federal contractors regarding government contract, labor and employment, and other laws. It also, however, gives them a chance to prepare for the next shutdown. Read the issues federal contractors should consider >>>

Tax Identity Theft Awareness Week: January 29 – February 2

It is tax time. The tax scammers are gearing-up. Learn how to protect yourself during Tax Identity Theft Awareness Week January 29-February 2, 2018. Tax identity theft occurs when a person uses someone else’s Social Security number to either file a tax return and claim the victim’s refund, or to earn wages that are reported as the victim’s income, leaving the victim with the tax bill. Read more here >>>

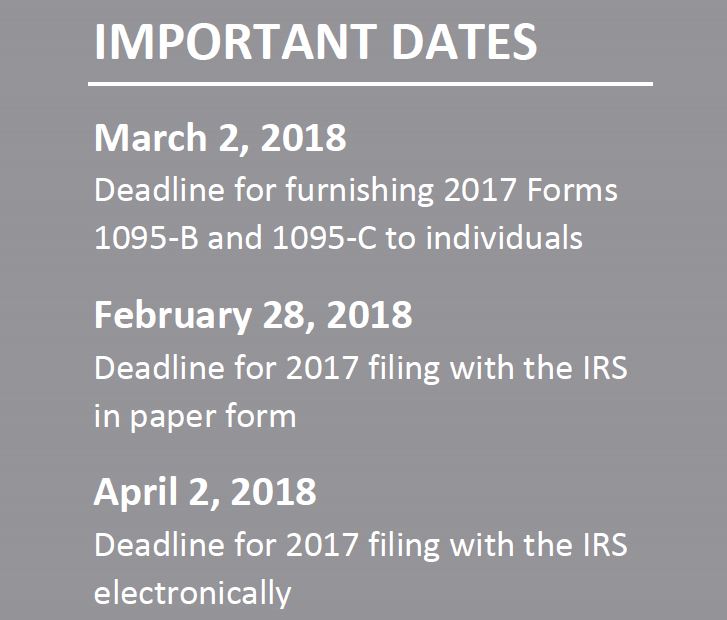

ACA Compliance – Furnishing Deadline Delayed for 2017 ACA Reporting

On December 22, 2017, the Internal Revenue Service (IRS) issued Notice 2018-06 to: Extend the due date for furnishing forms under Sections 6055 and 6056 for 2017 for 30 days, from January 31, 2018, to March 2, 2018; and Extend good-faith transition relief from penalties related to 2017 information reporting under Sections 6055 and 6056. Notice 2018-06 does not extend the due date for filing forms with the IRS for 2017. The due date for filing with the IRS under Sections 6055 and 6056 remains February 28, 2018 (April 2, 2018, if filing electronically). Section 6055 and 6056 Reporting Sections 6055 and 6056 were added to the Internal Revenue Code (Code) by the Affordable Care Act (ACA). Section 6055 applies …

OSHA Penalty Adjustments – Updated NOW for 2018

In November 2015, Congress enacted legislation requiring federal agencies to adjust their civil penalties to account for inflation. The new penalties took effect after August 1, 2016 and increased at the beginning of 2017 and now again at the beginning of 2018. Feel free to share this information with clients and prospects as appropriate using the OSHA New Penalty Schedule for 2018 compiled by our Risk Control Solutions.

Submitting Workplace Injury And Illness Data Electronically To OSHA In 2018 And Beyond

Establishments with 250 or more employees in industries covered by the recordkeeping regulation, as well as establishments with 20-249 employees that are classified in certain industries with historically high rates of occupational injuries and illnesses may now begin electronically submitting the 2017 data. The deadline for covered establishments to electronically submit 2017 workplace injury and illness information to OSHA is July 1, 2018. Beginning in 2019 and every year thereafter, the information must be submitted to OSHA by March 2nd. The requirement to provide injury and illness information to OSHA should not be confused with the Bureau of Labor Statistics’ (BLS) Annual Survey, a survey some companies receive requesting work-related injury and illness information. From OSHA’s FAQ page asking if establishments …

US Department of Labor Clarifies When Interns Are Subject To The Fair Labor Standards Act

By Erica Townes, McNees In a recent change of position, the Department of Labor (“DOL”) has endorsed a new standard for determining when an unpaid intern is entitled to compensation as an employee under the Fair Labor Standards Act (“FLSA”). We previously reported on an earlier DOL effort to tighten up the restrictions on the use of unpaid interns. It looks like the DOL has decided to change course. Read more on the McNees website >>>

- Page 1 of 2

- 1

- 2