By John Dettleff, Senior Managing Director, Brokerage, JLL for AreaDevelopment.com The United States will need one billion square feet of industrial space over the next five years to keep up with e-commerce demand — one billion! Throughout the COVID-19 pandemic, much attention has been paid to the future of office, but the industrial market is experiencing a similar tectonic shift. Prior to the onset of the coronavirus, the increase in online sales was driving growth in the industrial real estate sector. JLL found that nearly 35 percent of all industrial leasing was attributed to e-commerce pre-pandemic. After March 2020, as online sales experienced an explosion in growth, demand for distribution space skyrocketed, accounting for the majority of all industrial leasing …

Non-Profits and the Government Contracting Industry

By Jeff Ramsey for AssuredPartners.com The federal government has determined that non-profits that hire people with disabilities take priority when it comes to products and services that are purchased for, or in service of, the federal government. We will focus on those contracts that fall under the jurisdiction of the Service Contract Act. Non-profit agencies or contractors must adhere to the requirements of the McNamara-O’Hara Service Contract Act (SCA), where there is a fringe allocation for health and welfare benefits. SCA contracts pertain to contracts that perform jobs that fall into the service category. Examples of services that fall under the SCA include, but are not limited to: Custodial work Facilities maintenance Commissary shelf stocking Call centers Administrative service Document …

Risk Management Strategies to Reduce Your Liability

By Ashley Wilson for AssuredPartners.com Business leaders are forced with making impossible decisions as a result of the COVID-19 pandemic. Not just decisions about keeping their doors open, but decisions ranging from hiring and firing employees, to compensation, and how to provide safe work conditions during these unprecedented times. Unbeknownst to many employers, these difficult decisions are putting their business at risk for an Employment Practices Liability Insurance (EPLI) claim. As employment-related lawsuits are on the rise for employers of all sizes, it is critical for employers to understand these exposures in order to manage the risk of an EPLI claim. Read effective risk management strategies to reduce liability>>>

Five Critical COVID-19 Risks for the Manufacturing Industry

By Katie Dwyer for Risk&Insurance.com COVID-19 is impacting every business in some way, but manufacturers are under unique pressure. Though many have been forced to shut down, others have been called upon to help produce much-needed medical supplies. All are facing challenges with supply chain management, security, and the continual obligation to keep workers as safe as possible. Here are 5 risks facing manufacturers as they work through the pandemic: Supply Chain Disruption Economic Recession Vulnerabilities in Cyber Security Patent Infringement Liability Widespread Worker Illness Click for more details>>>

Ransomware Continues to Lead Cyber Attacks

By Jody Westby for LeadersEdge.com Experts predict that a company will be hit with ransomware every 11 seconds and the cost of these attacks will be $20 billion by the end of 2021. Why has ransomware been so successful? Two reasons: (1) companies have not developed and tested backup/recovery plans that enable them to fully restore systems encrypted by ransomware, and (2) they have not encrypted their data at rest. If an organization hit by ransomware has encrypted its data at rest and has full backup/restoration capabilities, it can just restore its systems, and the cyber criminals have to go elsewhere. The reality, however, is that many companies rolled the dice and chose not to fund the development of backup/recovery …

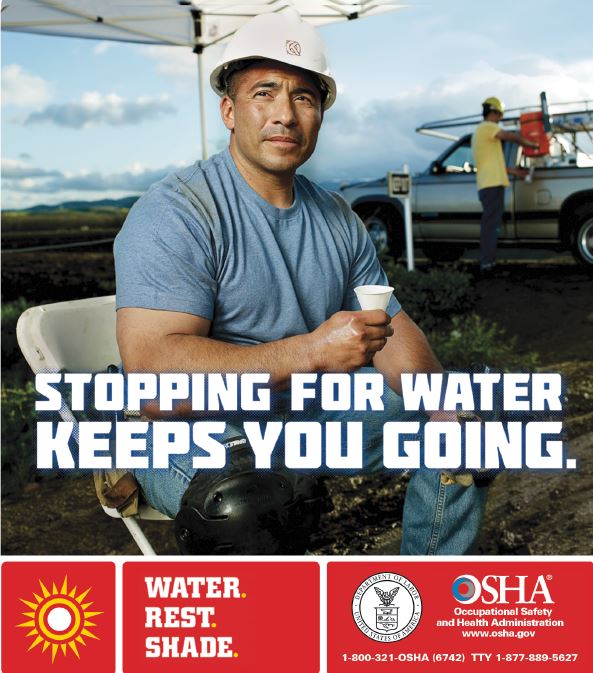

Water, Rest, Shade: Keeping Workers Safe in the Heat

Sponsored by Occupational Safety and Health Administration, US DOL Every year, dozens of workers die and thousands more become ill while working in extreme heat or humid conditions. There are a range of heat illnesses and they can affect anyone, regardless of age or physical condition. The informal kickoff date for the campaign is the Friday before Memorial Day – this year, Friday, May 22, 2021. Employer Responsibility to Protect Workers Under OSHA law, employers are responsible for providing workplaces free of known safety hazards. This includes protecting workers from extreme heat. An employer with workers exposed to high temperatures should establish a complete heat illness prevention program. Provide workers with water, rest and shade. Allow new or returning workers …

Guidelines for Opening a Pool for the Summer

By Brad Hagey for AssuredPartners.com With springtime in the air, now is the time to start thinking about opening your pool for the summer season. Most owners and operators consider opening pools when the temperature is consistently above 70 degrees during the day. Whether you plan to open the pool with your staff, or you hire a contractor, now is the time to start getting prepared. Tell me more>>>

How the Long-term Staying Power of COVID-19 is Impacting Workers’ Compensation

By Autumn Demberger for Risk&Insurance.com The coronavirus pandemic may have a vaccine, but that does not mean it’s been eradicated. Now is the time for workers’ comp professionals to recognize what the impacts of the virus could be moving forward. For the workers’ compensation industry, the time to adjust had to happen quickly and effectively. The first COVID-19 cases were confirmed in the United States early in 2020, and professionals in workers’ comp did not hesitate to act. In June 2020, myMatrixx first addressed this topic, diving into how best to address clients’ needs in very challenging times. As the virus continues to be a long-term concern, Hollie Lamboy, senior vice president, product development at myMatrixx, reflects on what that …

Stand by for Turbulence

By Jared Shelly for Risk&Insurance.com A deadly virus and unruly passengers have shaken aviation safety. Crew members are bearing the brunt of a new wave of passenger harassment while the dangers of contracting COVID-19 are ever present. “Flight attendants have become the mask police,” said Nicole, whose real name is being withheld because she’s not permitted to speak publicly. “My number one job is not to serve drinks. It’s to keep people safe. But it became exhausting.” And, it’s not just impacting aviation. Insurance implications Unlike other industries, “there are no COVID-19 exclusions in aviation liability insurance,” said Brad Meinhardt, area executive vice president and managing director of aviation at Arthur J. Gallagher, “but such exclusions have started to appear …

Surging Import Volume Creates Havoc in the Port Straining Intermodal Truck Drivers and Operations

By Mike Edwards, CIC, for AssuredPartners.com Since the COVID-19 pandemic began in March of 2020, intermodal trucking has gone on a roller coaster ride that has taken them to the highest of highs and lowest of lows. When the global lockdown first went into effect, imports fell due to most of Asia closing their ports and ceasing exports in an all-out effort to contain the virus. While U.S. port operations remained largely open, container volumes fell as there was simply less freight to import into the country. However, this trend quickly dissipated as the economy shifted from serviced-based to retail-based due to the growth of e-commerce and consumers purchasing more and more goods from online vendors. “U.S. containerized imports from …