By Nate Bunty for Murray

Housing affordability is one of the hottest current economic topics. Housing stock is down while rents and interest rates are up, and inflation is at its highest in a generation. Existing home sales, new construction, and the rental market are all feeling the effects.

For property managers and landlords, this environment requires new creative solutions to address affordability issues; legacy systems need to be rethought and retooled. Emerging alternatives to the traditional security deposit are making renting more attainable while protecting the interests of property owners.

Creative Solutions to an Evolving Proble

A few enterprising companies have developed alternatives to traditional security deposits that eliminate hassle for landlords or property managers and make newer, better rentals more attainable for tenants.

These alternative programs allow prospective tenants to choose between legacy security deposits or low-cost monthly payments. What the tenant gets for their monthly payment varies depending on which provider the property manager chooses.

Guarantors as a Deposit Alternative

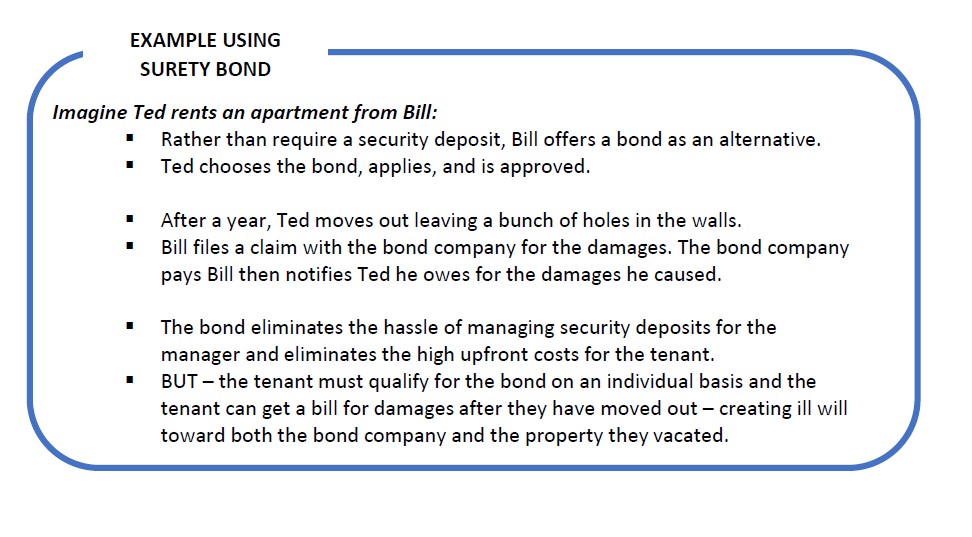

Surety bonds make up most of security deposit alternatives in the market. They act as a guarantee of funds if the tenant damages the property or skips out on rent without requiring the tenant to deposit the funds anywhere. Bonds guarantee the property manager or landlord will be paid and covers costs for damages – also collecting these funds from the tenant.

Insurance as a Security Deposit Alternative

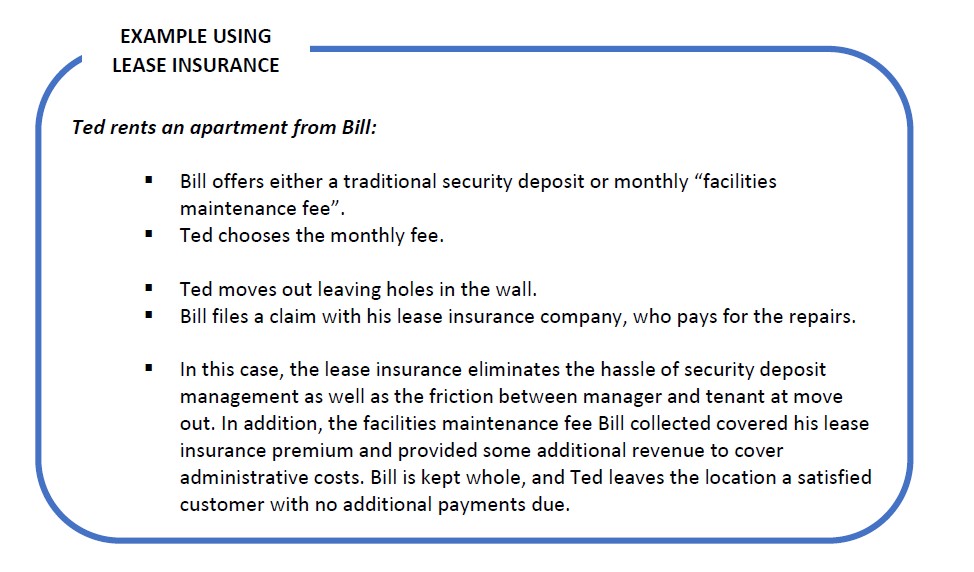

A few forward-thinking insurance companies now offer lease insurance products that make offering a security deposit alternative even easier. The lease insurance covers the property manager when a tenant causes excessive damage to the property or skips out on the last month’s rent, but, since it is true insurance, does not require collection from the tenant after the fact.

Additionally, the property manager’s tenant screening process qualifies any tenant approved for their properties for coverage so an individual application is not necessary.

Which Security Deposit Alternative is Better?

While it comes down to preference, bonds surely have their place in the market for certain customers. What do you think most of your prospective tenants would choose when offered the choice between a monthly product that will “collect” from them after the fact or a fee that fully covers their obligation?

The benefits of lease insurance provide tenants with fixed costs and eliminate the possibility of a bill for damages at the end of their rental term. It also provides the simplest way of doing business for the property manager – no individual qualification is needed so opting in is a breeze.

Exclusive Program

For more information on how to minimize the security deposit hassle with a lease insurance product, contact Nate Bunty, CIC, at nbunty@murrayins.com or 717.481.3312.

Share this Post