It is tax time. The tax scammers are gearing-up. Learn how to protect yourself during Tax Identity Theft Awareness Week January 29-February 2, 2018. Tax identity theft occurs when a person uses someone else’s Social Security number to either file a tax return and claim the victim’s refund, or to earn wages that are reported as the victim’s income, leaving the victim with the tax bill. Read more here >>>

ACA Compliance – Furnishing Deadline Delayed for 2017 ACA Reporting

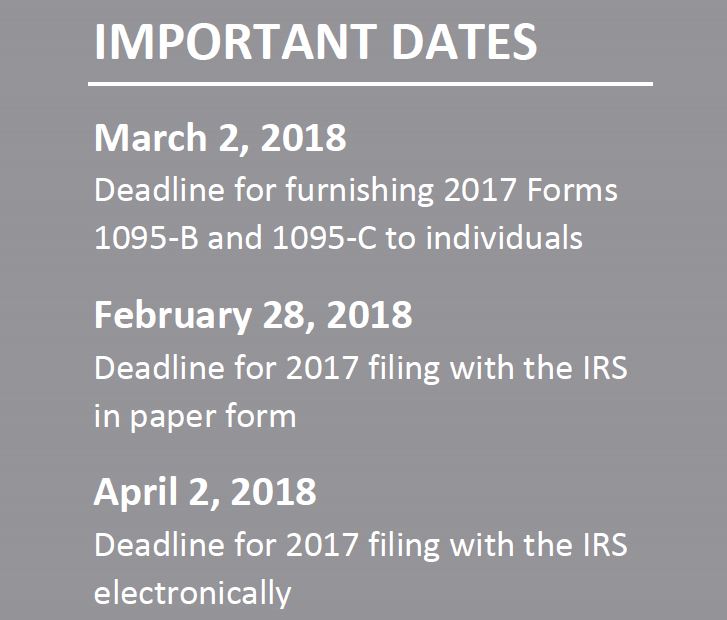

On December 22, 2017, the Internal Revenue Service (IRS) issued Notice 2018-06 to: Extend the due date for furnishing forms under Sections 6055 and 6056 for 2017 for 30 days, from January 31, 2018, to March 2, 2018; and Extend good-faith transition relief from penalties related to 2017 information reporting under Sections 6055 and 6056. Notice 2018-06 does not extend the due date for filing forms with the IRS for 2017. The due date for filing with the IRS under Sections 6055 and 6056 remains February 28, 2018 (April 2, 2018, if filing electronically). Section 6055 and 6056 Reporting Sections 6055 and 6056 were added to the Internal Revenue Code (Code) by the Affordable Care Act (ACA). Section 6055 applies …

OSHA Penalty Adjustments – Updated NOW for 2018

In November 2015, Congress enacted legislation requiring federal agencies to adjust their civil penalties to account for inflation. The new penalties took effect after August 1, 2016 and increased at the beginning of 2017 and now again at the beginning of 2018. Feel free to share this information with clients and prospects as appropriate using the OSHA New Penalty Schedule for 2018 compiled by our Risk Control Solutions.

Submitting Workplace Injury And Illness Data Electronically To OSHA In 2018 And Beyond

Establishments with 250 or more employees in industries covered by the recordkeeping regulation, as well as establishments with 20-249 employees that are classified in certain industries with historically high rates of occupational injuries and illnesses may now begin electronically submitting the 2017 data. The deadline for covered establishments to electronically submit 2017 workplace injury and illness information to OSHA is July 1, 2018. Beginning in 2019 and every year thereafter, the information must be submitted to OSHA by March 2nd. The requirement to provide injury and illness information to OSHA should not be confused with the Bureau of Labor Statistics’ (BLS) Annual Survey, a survey some companies receive requesting work-related injury and illness information. From OSHA’s FAQ page asking if establishments …

US Department of Labor Clarifies When Interns Are Subject To The Fair Labor Standards Act

By Erica Townes, McNees In a recent change of position, the Department of Labor (“DOL”) has endorsed a new standard for determining when an unpaid intern is entitled to compensation as an employee under the Fair Labor Standards Act (“FLSA”). We previously reported on an earlier DOL effort to tighten up the restrictions on the use of unpaid interns. It looks like the DOL has decided to change course. Read more on the McNees website >>>

Resilient Structures, Infrastructure Among 2018’s Trends In Construction

After a robust 2017, commercial construction companies are anticipating an even stronger 2018, with the majority reporting they plan to expand their staffs, according to Dodge Data & Analytics. As professionals seek to map out 2018 and beyond, there are a number of trends shaping the construction industry. Some are evolutions of past years, such as offsite construction and an increasing reliance on technology, and some trends are new, such as a focus on resiliency after the most damaging hurricane season on record and devastating fires in California. Read more here >>>

Court Denies Surety’s Move To Dismiss Case, Finds That Venue Was Proper

Use of the Word “in” Indicates Geography; Use of the Word “of” Indicates Sovereignty: Federal District Court in Maryland Holds That Venue Is Proper in Federal Court in Maryland Where Forum Selection Clause Requires Action to be Brought “In the District or County” Where the Prime Contractor Is Located. Tell me more >>>

Clear Contract Language Is Key When GCs Share Risk Of Nonpayment With Subs

Every contract involves the risk of insolvency, and every construction subcontract involves the risk of the owner/developer failing to make the payments that the contractor intends to use to pay its subcontractors. Frequently, general contractors seek to shift this risk onto their subcontractors through the use of clauses which describe payment from the owner to the contractor as a condition precedent to payment to the subcontractor. Simply put, when the contractor is successful in shifting the risk to the subcontractor, the clause is known as “Pay-If-Paid”. If contract language is not sufficient to transfer the risk, the clause is viewed as “Pay-When-Paid”. A Pay-When-Paid clause merely defers the timing of the payment due to the subcontractor until the contractor has …

Contractors Should Ensure Subs, Suppliers Comply With Buy American Act

The federal government has a long-standing preference for incorporating domestic materials and products into public construction projects. While a number of statutes and regulations promote this policy, the Buy American Act of 1933 (BAA) is the oldest and arguably most well-known. The essence of the BAA’s construction provisions sounds simple: the use of foreign-produced materials and products on public construction projects is prohibited. However, a dense web of regulations and statutes interact to create exceptions and exemptions to the BAA’s application, making the BAA one of the most complex bodies of law to comprehend. Those contractors who fail to comply with the BAA’s requirements can face costly legal issues, debarment or, in some situations, criminal investigation and prosecution. With the …

Report: Majority of Contractors Not Utilizing Emerging Safety Tech

Most construction contractors are not utilizing emerging technology such as drones to improve workplace safety, but change is expected as the benefits of using these technologies are proven, awareness grows and their prices start to decrease, according to a new study. The study found that 62% of contractors do not use any of these technologies, which is “no surprise” considering they are still emerging, according to the report by Silver Spring, Maryland-based CPWR-The Center for Construction Research and Training and New York-based Dodge Data & Analytics published Tuesday. Tell me more >>>