By Gina Ekstam for AssuredPartners.com Workers in grain handling facilities are exposed to many serious and life-threatening hazards, including fires, falls, and amputations. Suffocation, however, is the leading cause of death in grain storage bins, occurring when an employee becomes engulfed or entrapped inside a bin. Research by Purdue University’s Agricultural and Biological Engineering Department reveals an increase in the number of documented cases involving all types of agricultural confined spaces, including grain entrapments. In 2019, the 38 grain entrapment cases recorded represented a 26.7% increase from 2018, substantially higher than the five-year average of 28.8 cases per year. Of the total number of reported entrapment cases, 61% resulted in a fatality, a rate higher than the five-year average. OSHA’s …

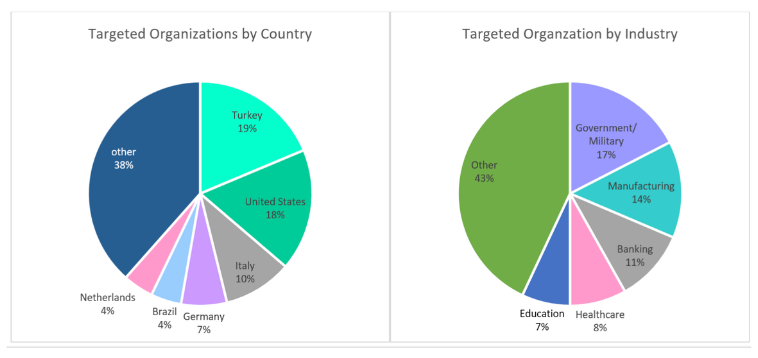

Microsoft Exchange Server Hacks ‘Doubling’ Every Two Hours

By Charlie Osborne for Zero Day Cyberattackers are taking full advantage of slow patch or mitigation processes on Microsoft Exchange Server with attack rates doubling every few hours. On March 12, Microsoft said that a form of ransomware, known as DearCry, is now utilizing the server vulnerabilities in attacks. The tech giant says that after the “initial compromise of unpatched on-premises Exchange Servers” ransomware is deployed on vulnerable systems, a situation reminiscent of the 2017 WannaCry outbreak. “Compromised servers could enable an unauthorized attacker to extract your corporate emails and execute malicious code inside your organization with high privileges,” commented Lotem Finkelsteen, Manager of Threat Intelligence at Check Point. “Organizations who are at risk should not only take preventive actions on their Exchange, but …

Everything You Need to Know About the Microsoft Exchange Server Hack

By Charlie Osborne for Zero Day Four zero-day vulnerabilities in Microsoft Exchange Server are being actively exploited by a state-sponsored threat group from China and appear to have been adopted by other cyberattackers in widespread attacks. While in no way believed to be connected to the SolarWinds supply chain attack that has impacted an estimated 18,000 organizations worldwide — so far — there is concern that lags in patching vulnerable servers could have a similar impact, or worse, on businesses. Read everything you need to know about the security issues and be updated as the story develops>>>

Should You File a Home Insurance Claim?

By G.M. Filisko for Houselogic.com It’s that age-old conundrum: You pay for homeowners insurance to protect yourself from financial ruin, yet filing a claim when disaster does strike puts you at risk of seeing your annual premiums increase by hundreds of dollars. Worse, either a major claim or too many claims in a given period, no matter how legitimate, could lead to losing your house’s coverage altogether. While it can be a fine calculation to make, every time there’s damage to your property or an accident on it, you need to consider carefully whether it makes financial sense to file a claim or absorb the losses yourself. The fates of your homeowners insurance and your bank account hang in the …

New Benefit Plan Compensation Disclosure Requirements

By Scott Sinder and Kate Jensen for Leadersedge.com On Dec. 27, 2020, the “Consolidated Appropriations Act of 2021” was signed into law. The 5,593-page missive includes the “No Surprises Act,” which encompasses a host of new healthcare payment-related initiatives of particular interest to us. Section 202 of the act dictates that, effective Dec. 27, 2021 (more on that in a moment), a “covered plan” shall not agree to any “contract or arrangement for services” or to any “extension or renewal of such contract or arrangement” with a “covered service provider” unless the new disclosure obligations it imposes have been satisfied. Read who must make the new requisite disclosures, to whom, and when>>>

March is National Ladder Safety Month

The American Ladder Institute has designated March as National Ladder Safety Month – the only movement dedicated exclusively to the promotion of ladder safety, at home and at work. Are you choosing the right ladder? Are you taking the time to properly inspect your ladders before starting to work? Did you know a thorough inspection should be made when the ladder is initially purchased and each time it is placed into service? Make ladder safety a priority and participate this month. Click for more information regarding ladder safety training and awareness provided by the American Ladder Institute. Contact a member of the Murray Risk Control Team at 717.397.9600 for additional resources and tools for prevention. #LadderSafetyMonth

Positive Employer Work Order Versus Positive Employee COVID-19 Test

By Caitlin M. Sullivan for Chartwelllaw.com Can employers limit workers’ compensation liability against employees who refuse the COVID-19 vaccine? It’s the news we have been waiting to hear for months. Operation Warp Speed has successfully accelerated the development and production of COVID-19 vaccines, and while the actual distribution of the vaccine has caused chaos, the fact that a “shot in the arm” may be just around the corner is enough to calm the anxiety of many. But news of the COVID vaccine distribution has employers faced with several legal questions. Not only are employers wondering whether vaccines can be mandated, but also, what recourse do employers have when an employee refuses to get a vaccine and contracts COVID while at …

Diversity in the workplace

By Andrea Wells for InsuranceJournal.com Insurance industry leaders have renewed their focus on recruiting, hiring and promoting not just to fill a crucial talent gap with quality candidates, but also to intentionally diversify their workforce. The civil unrest nationwide last summer, the Black Lives Matter movement and calls for police and judicial reforms have contributed to the unprecedented attention given to the cause of diversity and inclusion in the industry. “There’s never been a moment like this. I think most people would agree with that. And so what we do at this moment is yet to be seen,” Margaret Redd, executive director of the National African American Insurance Association, told Insurance Journal, last fall. Diversity and inclusion conversations are about …

Six Steps to Take After a Car Accident

By Eric Rosenberg for Westfield Insurance Car accidents happen—and sometimes there’s nothing you can do about it. These accidents are far more common than you might think. Data from the last U.S. Department of Transportation, National Highway Traffic Safety Administration survey in 2018 showed there were over 6.7 million car crashes in the U.S. that year. Of those accidents, nearly 1.9 million resulted in injuries and over 4.8 million of these accidents involved property damage. But while getting into an accident can shake you up, there are important steps to take after one occurs. These measures can help ensure everyone is safe, that the law is being followed and that the car accident claim process is as streamlined as possible. Stay calm …

10 Reasons Healthcare Entities Need Cyber Coverage

Ransomware attempts jumped 50% in the first half of 2020; hospitals and health care organizations were the hardest hit. Why? Because with your focus on caring for your residents through the COVID crisis, hackers figured out that you were the easiest prey. They think you’re desperate and willing to pay to prevent the harm they will cause to you and your residents. Well, we think you’re smart enough to protect your residents and your business. Need more reasons to purchase or increase your cyber insurance coverage? Click here for 10 Reasons Healthcare Entities Need Cyber Coverage and give us a call at 717.397.9600. We would love to help!